A 2021 UN warning made it clear that we can no longer stop climate change; the only thing we can do is slow it down to reduce its impact over the long term.

Several countries have pledged to reduce their carbon emissions by 2050, with some pledging to be net zero by or before then. Sweden and Germany created legally binding targets to be net zero by 2045. France, Ireland, Fiji, Denmark, Spain, Hungary, Japan, Korea, Canada, New Zealand, and Luxemburg have set their targets for 2050.

As the corporate world has accepted that there is no Planet B, ESG has become a mainstay. By its very nature, ESG also covers governance and social issues, but in 2023 its primary focus is on environmental sustainability. As the most recent World Economic Forum Global Risks Report highlighted, climate change is a “our house is on fire” situation that demands our full attention.

Aside from being crucial to avoid a climate disaster, ESG is also becoming a badge of honor for businesses. A major purpose of ESG reporting is to illustrate that compliant businesses strive to make a positive impact on the world, often prioritizing the good they can do over their own bottom line.

The truth of the matter is that full ESG compliance is not out of reach for any company in any industry. In fact, the top-rated US company in terms of ESG score is Worthington Industries, a global diversified metals manufacturing company. Worthington Industries has an ESG score of 75.82. Close on its heels is J.B. Hunt Transport Services, a transportation and logistics company, with a score of 73.09.

A company’s ESG score ranges from 0-100 and allows investors to compare its performance to its competitors. A score of less than 50 represents poor performance, and a score of more than 70 represents excellent performance.

One thing is clear: ESG is here to stay, and it is growing in importance, but ESG doesn’t happen on its own. It needs committed executives to champion it. Enter the CFO.

Understanding the Importance of ESG for CFOs

Not too long ago, the role of a CFO mainly involved overseeing cash flow, creating financial plans, and identifying any financial strengths and weaknesses within the company. However, things have changed in recent years. CFOs are increasingly expected to be leaders in sustainability and ESG matters within their organizations. As organizations contend with perceptions of “greenwashing”, or even “greenhushing”, front-line accountability often resides with the CFO. In fact, data shows that more than two-thirds of CFOs are now responsible for their company’s ESG compliance and reporting, and more than 200 CFOs from a selection of 8,000 companies mentioned ESG during their quarterly earnings calls (as shown in figure 1).

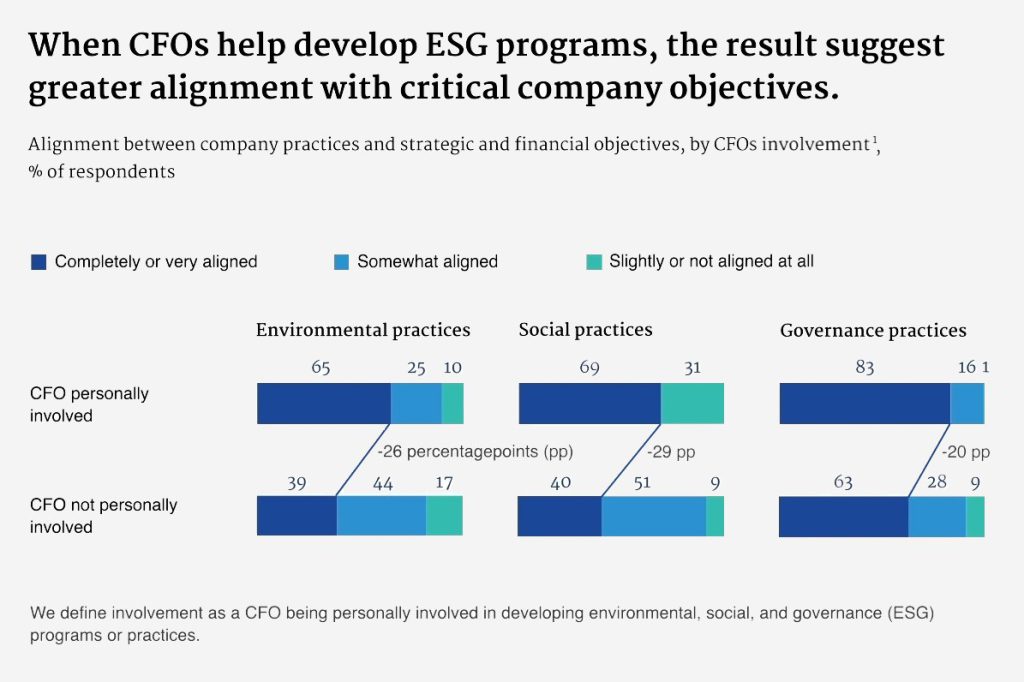

This is not surprising, as finance teams already possess many of the skills necessary to drive ESG outcomes, such as monitoring and reporting, cost optimization, and risk management. The numbers show that when a CFO takes on the responsibility of developing ESG programs, it leads to a stronger alignment with the company’s objectives, as much as 26-29% more (as shown in figure 2).

Of course, taking on extra responsibilities related to ESG can be challenging for CFOs. They must find a way to balance long-term sustainability goals with the need to meet short-term financial targets. It is a delicate balance. A CFO is also required to foster even more cooperation with other functional areas across the organization when overseeing ESG in order to obtain the appropriate data for measuring and reporting, identify areas where ESG performance can be improved, and drive change throughout the entire company.

In addition to managing conflicting interests, a CFO’s role in ESG management requires them to be knowledgeable of a variety of ESG topics. For CFOs to stay ahead of ESG trends and developments, they must constantly upskill and update their knowledge. Faced with an ever-evolving ESG landscape, continuous professional development and education are a must.

“Faced with an ever-evolving ESG landscape, continuous professional development and education are a must.”

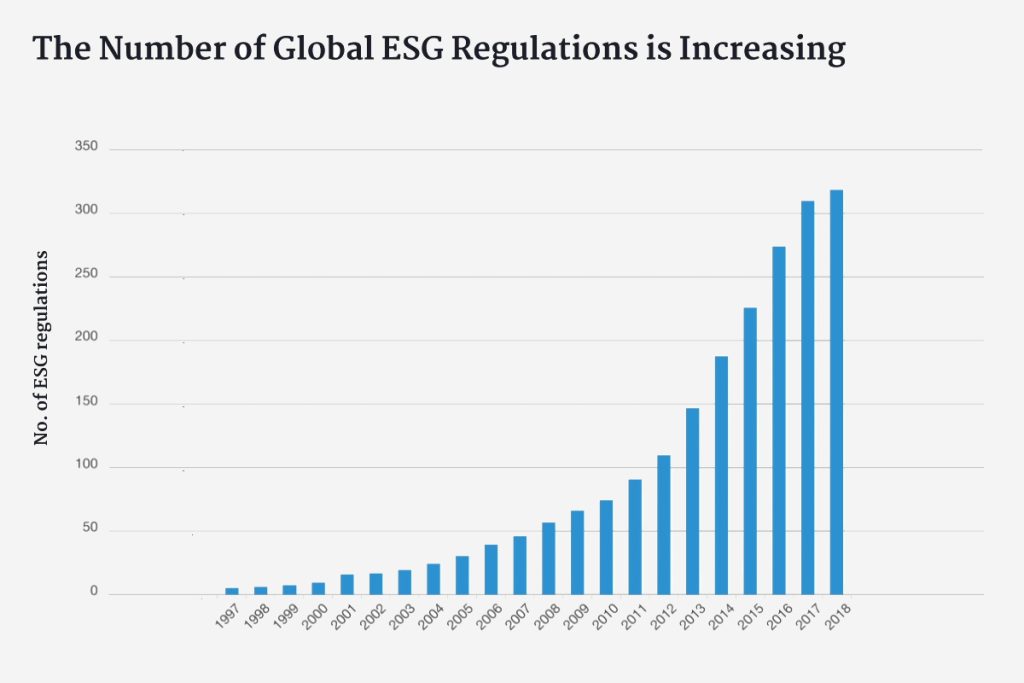

Most commonly, the CFO’s role in an organization’s ESG initiatives involves ensuring compliance with relevant regulatory and policy frameworks, as well as setting and achieving the organization’s ESG objectives. Countries, industry regulators, and stock exchanges are increasingly incorporating stricter ESG compliance and reporting requirements into their regulations and laws as investors, consumers, and voters push for more effective safeguards to be put in place to protect the environment, communities, and economies (as shown in figure 3).

The role of the CFO in an organization’s ESG initiatives has expanded beyond traditional internal responsibilities. Historically, CFOs were primarily responsible for communicating financial performance to external stakeholders such as investors, consumers, and the broader market. However, with increasing focus on ESG, beyond their accountability to the Board and Audit Committee, CFOs must now also report on the company’s progress on ESG issues and initiatives to external stakeholders, and quite often activist investors, who are increasingly considering ESG factors in their investment and resource allocation decisions. The failure to demonstrate a commitment to ESG can result in reputational risks, financial consequences, not the least of which is eroded access to capital, and loss of business and market share as more and more consumers demand sustainable practices.

Failing to meet ESG standards not only puts companies at risk of losing investors and consumers, but also of losing future talent. A recent study by WeSpire found that Generation Z prioritizes purpose over compensation, meaning that younger employees are more likely to seek out companies that align with their values and contribute positively to the world, as shown in figure 4. This trend is expected to continue, with future generations placing even greater importance on environmental and social responsibility in the workplace. As a result, not complying with ESG standards could lead to challenges in attracting and retaining top talent for companies in the long term, regardless of the salary or benefits offered.

In spite of these challenges (or rather, as a result of them), the CFO’s leadership in ESG matters is more important than ever before. Through full ESG engagement, CFOs can not only mitigate risks and enhance the public’s perception of their company, but also contribute to the creation of a more sustainable future.

The Role of CFOs in ESG

It is important to understand that incorporating ESG into the CFO role touches on several key areas that can have a significant impact on your organization.

- Stakeholder relations: We briefly mentioned this responsibility in the previous section of this white paper; however, it bears repeating. As ESG leaders, CFOs are not only responsible for communicating their organization’s ESG performance to its stakeholders, but they are also responsible for trying to understand their ESG concerns and priorities so that ESG initiatives can be shaped around them.

- Risk management: As the financial stewards of their organization, CFOs are expected to be adept at managing financial risks, however, something that may not be top of mind is that not adhering to ESG standards can also pose a financial risk in and of itself. There must also be a deep appreciation of the risks associated with engaging in practices that are harmful to the environment or lack social responsibility, given the potential negative impacts on stock price and customer loyalty. More broadly, CFOs must be cognizant of the legal repercussions, including fines or lawsuits, if their organization is found to be in violation of laws intended to protect the environment or promote diversity.

- Long-term financial performance: ESG is not a fad; it is a long-term business imperative. Often when we talk about sustainability in business, we mean the business’s continued ability to be a profit-bearing entity. However, when it comes to ESG, sustainability of the environmental kind can also contribute to improved financial outcomes. The reason for this is quite logical: more than three quarters of consumers have indicated a company’s ESG performance impacts their buying habits. Companies that are good global citizens, who care about their employees, their communities, and their environments, are likely to pick the financial fruits of their labors.

- Financial advisory: ESG initiatives and investments do not come without a cost attached. However, CFOs are perfectly positioned to be able to assess whether the cost of any particular ESG initiative is worth it for the company involved in terms of return on investment. As an ESG leader, one of the CFOs main tasks is identifying financially viable ESG initiatives.

- Efficiency and cost savings: Implementing ESG initiatives usually comes with initial financial investment, but it is important to note that many of these initiatives can ultimately lead to cost savings. For example, a CFO who develops a plan to reduce a company’s energy consumption or water usage will not only be contributing to the company’s sustainability goals but drive tangible cost savings. Similarly, fleet costs can be reduced by setting fuel reduction targets, production processes can be made more efficient to decrease raw material wastage, and companies can decrease their carbon footprint by investing in renewable energy production, which can also lead to long-term cost savings.

All in all, CFOs can help their organizations be more financially successful and socially and environmentally responsible by viewing their role through an ESG lens and keeping sustainability, diversity, equity, and good corporate governance top of mind.

Metrics in CFO-Led ESG

A CFO’s ESG strategy should consider several metrics. The most pertinent ones include:

- Carbon emissions: When it comes to fighting the battle against climate change, no metric is more important than measuring a company’s greenhouse gas (GHG) emissions. This metric is derived by measuring the greenhouse gases (GHGs) emitted during the course of an organization’s operations. It should include considerations regarding GHGs produced during manufacturing, logistics and transportation, the GHG emissions produced by suppliers, and as a result of any office spaces being utilized by the company.

- Water usage: If your organization operates in a water scarce country like Cyprus or Qatar, you are likely already familiar with the importance of keeping a finger on the pulse of your organization’s water consumption. However, in an age where ESG is being integrated with the CFO role, it is crucial that all CFOs, regardless of their location, take note that water usage and water wastage will impact their ESG outlook and the public’s perception of their business, especially as climate change continues to drive water scarcity. Where possible and feasible, CFOs should consider how they can engage across the organization to implement measures to reuse water or reduce unnecessary water usage.

- Waste reduction: After considering water usage and greenhouse gas emissions, the next logical ESG consideration is waste. CFOs who have been tasked with becoming ESG leaders need to consider ways that their organization’s waste can be reduced, reused, or recycled. In cases where waste can be reused or recycled, being mindful of waste reduction may also lead to a positive financial outcome. This is also true of general waste reduction which would lead to a decrease in disposal costs.

- Employee diversity and inclusion: As we mentioned earlier, all ESG role-players need to continuously remind themselves that ESG is about more than just environmentalism. Consequently, CFOs filling this function need to task themselves with fulfilling the ‘S’ part of ESG too: social responsibility. This can be achieved by setting and tracking employee diversity and inclusion goals. To further enhance the accountability for these initiatives, it is also advisable to make these goals available to your organization’s stakeholders. CFOs can track metrics such as the percentage of women and minorities in leadership positions, as well as employee retention and satisfaction rates.

- Supply chain sustainability: Recently, supply chain shortages have been one of the common concerns across many industries. This is understandable considering the urgency that a dwindling supply chain can create. However, ease of supply is not the only thing companies should consider when thinking about their supply chains; they also need to consider their supply chains’ sustainability and their suppliers‘ ESG impact. CFOs taking the lead as ESG professionals should consider tracking metrics like the number of materials being sourced from sustainable resources and whether or not suppliers are meeting the organization’s predetermined ESG expectations and standards.

As a CFO, being an ESG leader begins with measuring key ESG metrics, setting improvement goals, and ensuring company-wide buy-in that supports each. It is important to note, however, that there are still additional considerations that need to be taken into account.

The first of these considerations is the fact that CFOs will be expected to report on their ESG performance. Fortunately, there are a variety of platforms and tools CFOs can access to make this reporting easier, namely internal systems like sustainability reporting software and external platforms like the Dow Jones Sustainability Index. What gets measured gets managed.

“What gets measured gets managed.”

Choosing an ESG framework to use as a measure of progress is crucial before starting the reporting process. There are currently two primary frameworks – the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). Despite being the most common, the GRI and SASB are by no means the only ESG frameworks out there. There are also the Carbon Disclosure Project (CDP) and the Climate Disclosure Standards Board (CDSB). The best framework (or frameworks) for your organization will depend on its unique needs and goals.

Recent ESG Developments CFOs Need to Be Aware Of

It would be an understatement to say that the realm of ESG is developing at lightspeed. That also means that CFOs who act as ESG leaders need to make a concerted effort to stay up to date with the latest ESG news. At the start of 2023, the most pertinent ESG developments are:

- The EU Taxonomy for Sustainable Activities: The EU Taxonomy for Sustainable Activities came into effect at the beginning of 2023. This system aims to clarify and classify which business can be considered “green” in the context of the European Green Deal to further avoid greenwashing. Under this system, listed companies with 500 employees or more will need to disclose what they are doing to meet the EU’s sustainability criteria. This measure was introduced to curb the recent instances of greenwashing that saw companies like the DWS Group being investigated for overstating their ESG credentials.

- The EU CSRD: In November 2022, the European Parliament and the European Council finalized the corporate sustainability reporting directive (CSRD) that aims to address shortcomings in the existing rules on the disclosure of non-financial information relating to sustainability. The directive amends the 2014 non-financial reporting directive and introduces more detailed reporting requirements for large companies to report on sustainability issues such as environmental rights, social rights, human rights, and governance factors. The CSRD also requires certification for sustainability reporting and improves accessibility of information by requiring its publication in a dedicated section of company management reports. The directive will be implemented in three stages starting in January 2024.

- The SEC’s Proposed ESG Rules: In March of 2022, the US Securities and Exchange Commission (SEC) proposed a batch of new rules that would require registered companies to make thorough and accurate climate-related disclosures in their SEC filings. These disclosures would need to contain information about the companies’ greenhouse gas emissions, the progress made on any publicly announced climate or sustainability goals, and the management protocols being put in place to ensure sustainability.

It is likely that other regulatory bodies and countries will soon follow suit in implementing rules and policies that mandate the honest reporting of ESG metrics in order to safeguard not only the environment, but also the interests of consumers and investors.

CFOs Are at The Intersection of Sustainability and Finance

As the world awakens to the importance of sustainability, CFOs find themselves in the driver’s seat of evaluating the financial impact of their company’s green initiatives. They have the tools and the expertise to dig into the numbers and understand both the financial and non-financial outcomes of their sustainability efforts.

“CFOs have got the tools and the expertise to dig into the numbers and understand both the financial and non-financial outcomes of their sustainability efforts.”

However, it is not just about crunching numbers; CFOs have the power to help reimagine their company’s approach to sustainability and chart a course toward a more sustainable future. They can also build efficient data infrastructure and rally cross-functional teams to tackle sustainability challenges head-on.

When it comes to communicating a company’s sustainability performance to stakeholders, CFOs’ unique insights into the convergence of sustainability and financial performance make them the ultimate ESG ambassadors.

About the Authors

Christian Ehl is a Partner at Stanton Chase Düsseldorf and the Global Practice Leader of Stanton Chase’s ESG Practice. He has 19 years of experience in executive search, leadership advisory, sustainability, and ESG.

He finished his studies in international business administration at the Accadis Business School. He also completed a separate degree from the University of Newcastle (UK). He speaks German and English fluently and has a good understanding of Spanish.

Cathy Logue has over 30 years of executive search and financial leadership experience and is a founding Managing Director of the Stanton Chase Toronto office..

As Global Leader of Stanton Chase’s CFO & Financial Executives Practice, Cathy is a trusted partner to many long-standing clients. She is also certified in Hogan Assessment.

She sits on the Board of the Association of Executive Search and Leadership Consultants (AESC) and previously served as Vice Chair on the Stanton Chase Board of Directors.

Prior to her career in executive search, Cathy obtained her Chartered Accountant designation, and was awarded the Fellow (FCPA, FCA) designation in 2017. In 2021, she was recognized by the WXN Top 100: Most Powerful Women in Canada for her efforts in advancing women in leadership.

Click here to learn more about Christian Ehl.

Click here to learn more about Cathy Logue.

How Can We Help?

At Stanton Chase, we're more than just an executive search and leadership consulting firm. We're your partner in leadership.

Our approach is different. We believe in customized and personal executive search, executive assessment, board services, succession planning, and leadership onboarding support.

We believe in your potential to achieve greatness and we'll do everything we can to help you get there.

View All Services