Compensation and benefits are critical factors in attracting and retaining top talent in any industry.

Stanton Chase Korea recently conducted an executive compensation and benefits survey, targeting general managers overseeing Korean operations for international firms. The findings are rich with insights that can guide businesses in designing compensation packages that resonate with their prospective hires and existing teams in Korea—a crucial factor in attracting, retaining, and fueling top talent.

This article deciphers some of the significant discoveries from our survey and presents these nuggets of information in a digestible format. The ultimate objective is to arm you with practical knowledge that can inform decisions surrounding your Korean expansion and optimize the long-term success of your business.

Executive Summary

- 34% of the respondents changed jobs at least once since becoming General Managers.

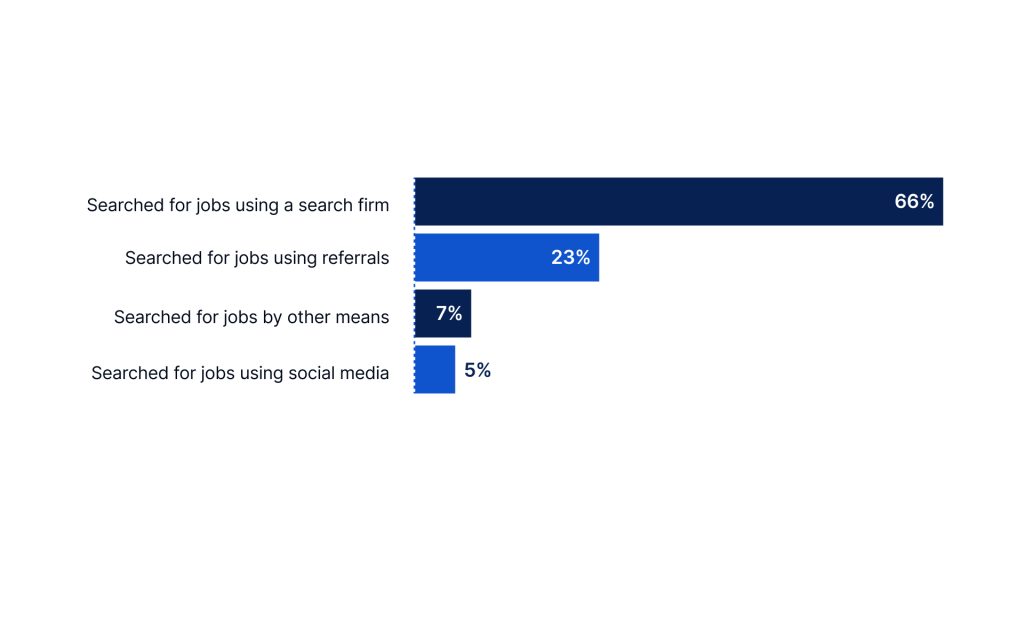

- The most common methods used for job searching were executive search firms (66%) and referrals (23%).

- Growth opportunities were the primary motivation for a job change, overriding compensation rates and benefits in importance.

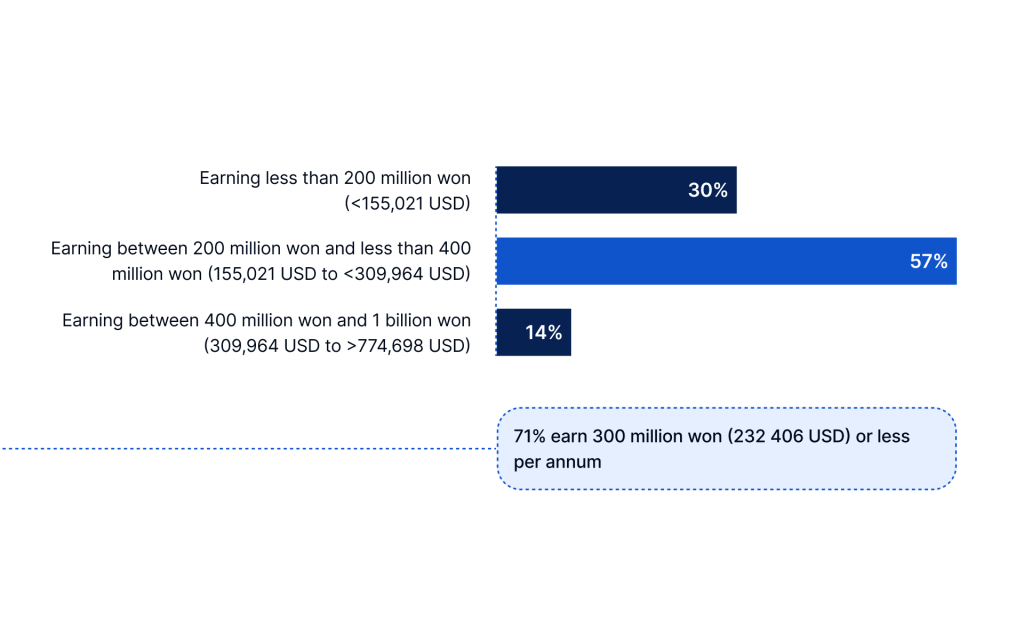

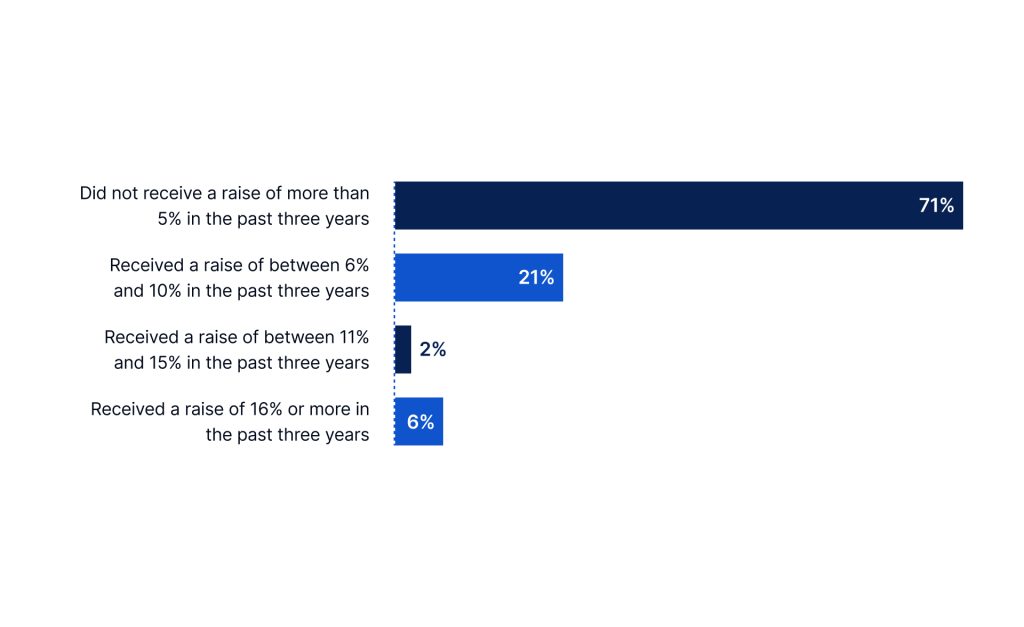

- Around 71% of respondents earn 300 million won (232 728 USD) or less annually as a base salary, and salary increases over the past three years for the same majority (71%) have been less than 5%.

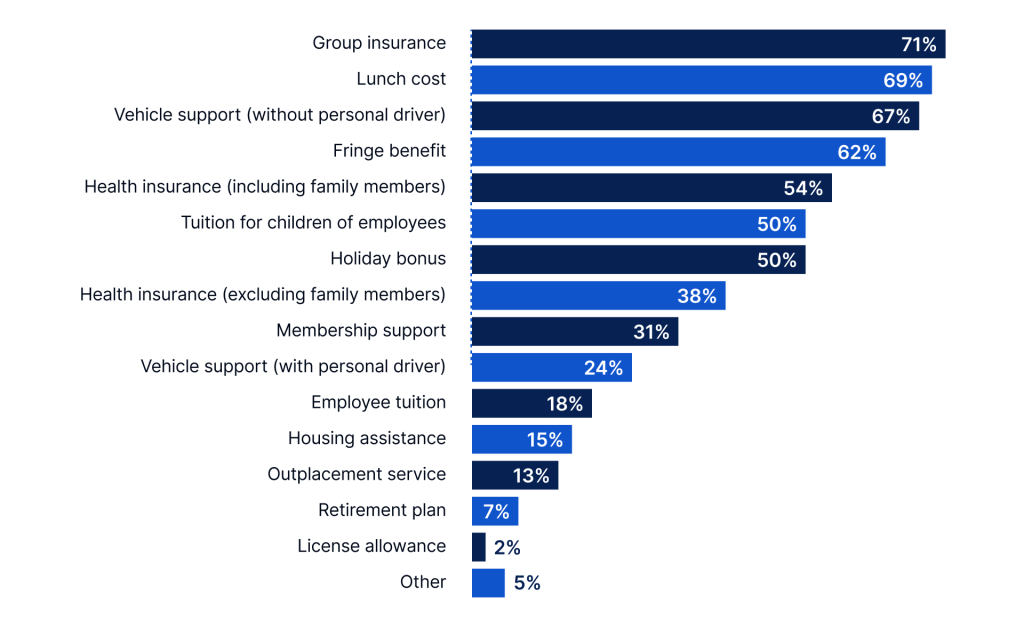

- Common benefits included group insurance, lunch costs, and vehicle support, but other beneficial offerings like license allowances and retirement plans were scarce.

- Most respondents (38%) have between 21 and 24 days of paid vacation per year. Only 8% of respondents have 15 days or fewer of paid vacation.

- Higher satisfaction was correlated with benefits that were not necessarily the most common, such as vehicle and tuition support.

- A considerable part of the surveyed population expressed the intention to remain in the General Manager role, though possibly in different industries.

Survey Demographics

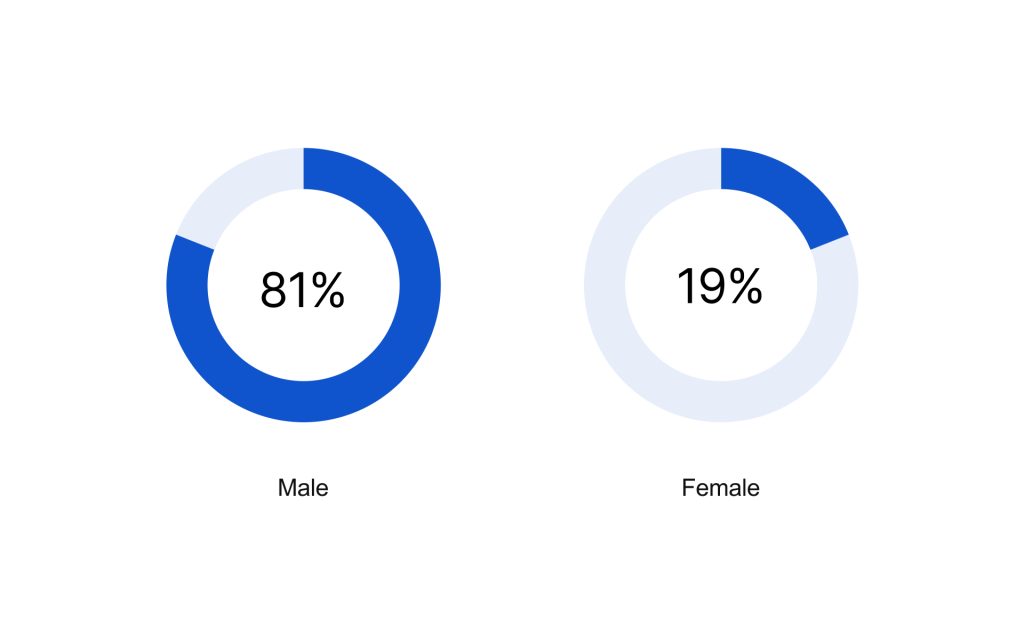

Our survey attracted feedback from the heads of international companies with branches in Korea. Out of 129 participants, 81% identified as male and 19% identified as female.

The age of the respondents varied greatly, with the highest percentage (between 50 and 59 years) accounting for most of the feedback.

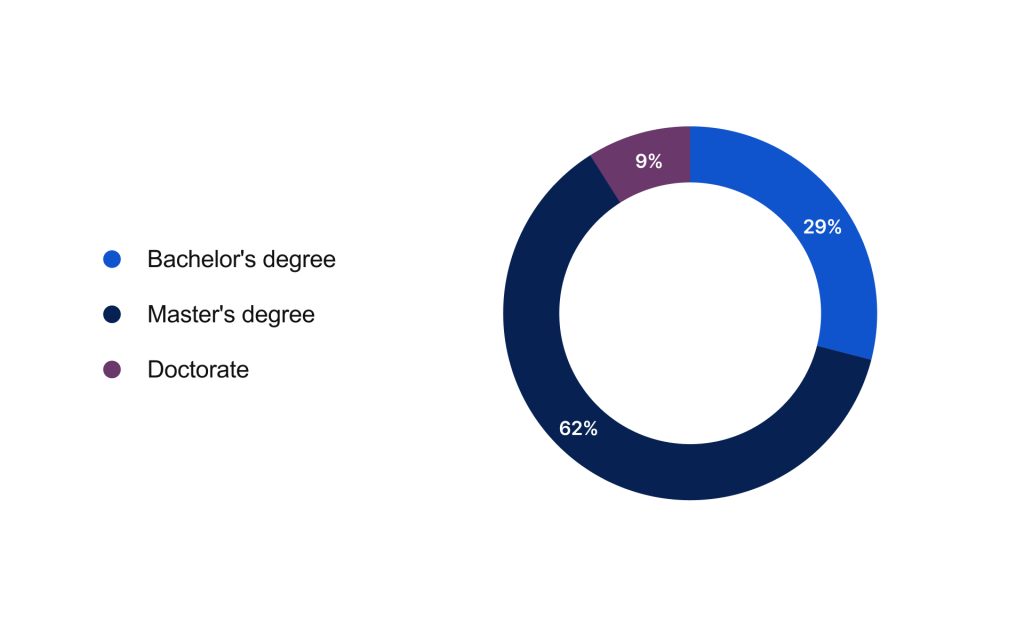

A significant number of the respondents have a master’s degree (62%), indicating that international companies in Korea tend to employ highly-educated individuals.

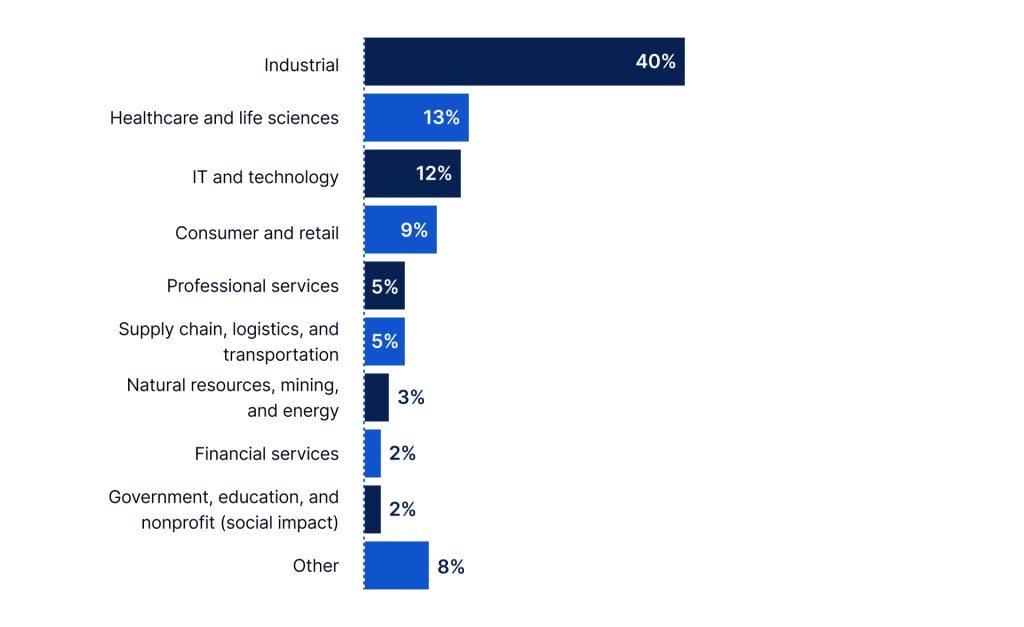

The respondents’ companies came from a variety of industries, including industrial, IT and technology, healthcare and life sciences, and consumer goods and services, amongst others.

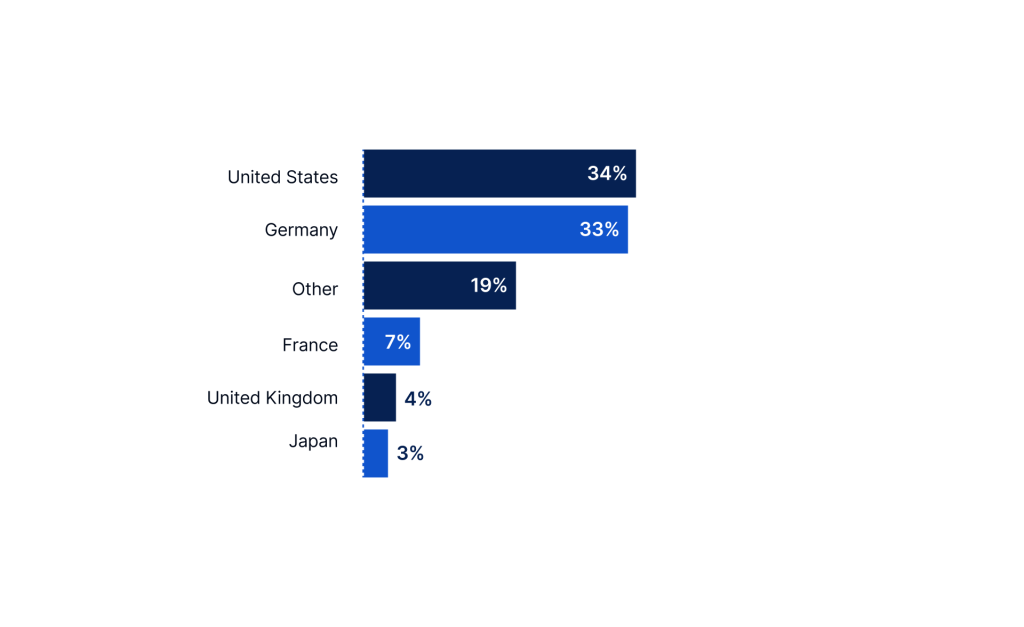

The majority of the companies where the respondents work have their headquarters in the USA (34%) and Germany (33%).

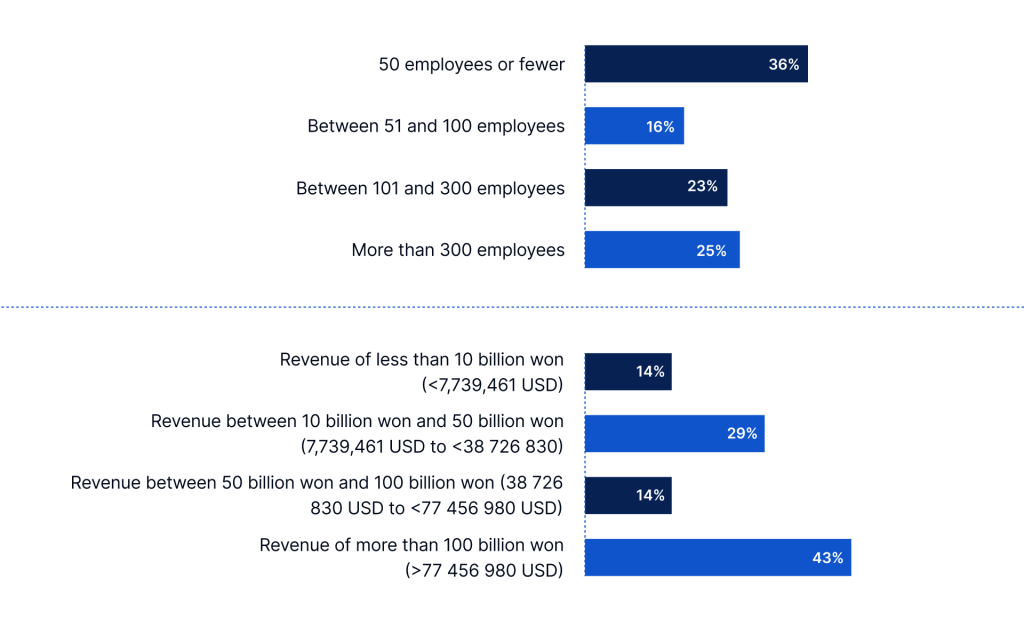

Most of the surveyed companies’ Korean branches (36%) are small to mid-sized businesses with less than 50 employees, indicating that international companies that have established branches in Korea tend to start small. But while their workforce might be small, their revenues aren’t. Forty-three percent of the surveyed companies have sales revenues exceeding 100 billion won (77 313 810 USD).

Turnover, Retention, and Retirement Plans

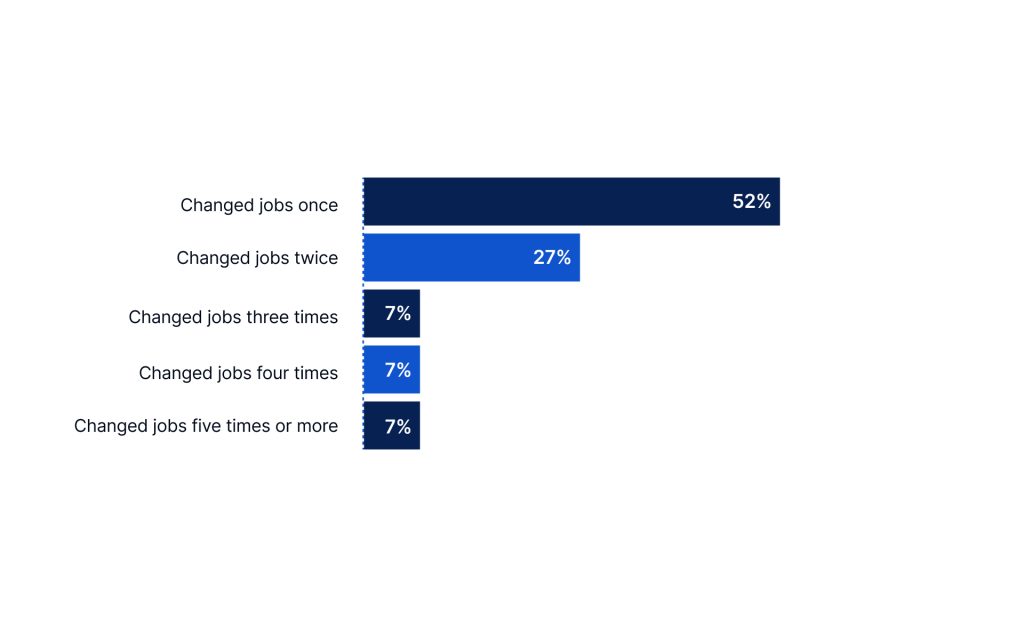

Thirty-four percent of the respondents changed jobs since first becoming General Managers. Thirty-two percent of them took three to six months to transition into their new roles. This underlines considerable dynamism within executive roles, with higher-than-expected mobility even at the highest rungs of corporate hierarchy.

Also interesting is 52% of respondents having experienced only one job change, while a significantly smaller percentage (7%) has undergone five job changes or more. This disparity could suggest that, despite an overall high turnover rate, a majority of General Managers find stability after the initial transition.

The most common job search methods reported were executive search firms (66%) and referrals from acquaintances (23%). These figures imply a preference for traditional, personalized methods over more modern, digital ones.

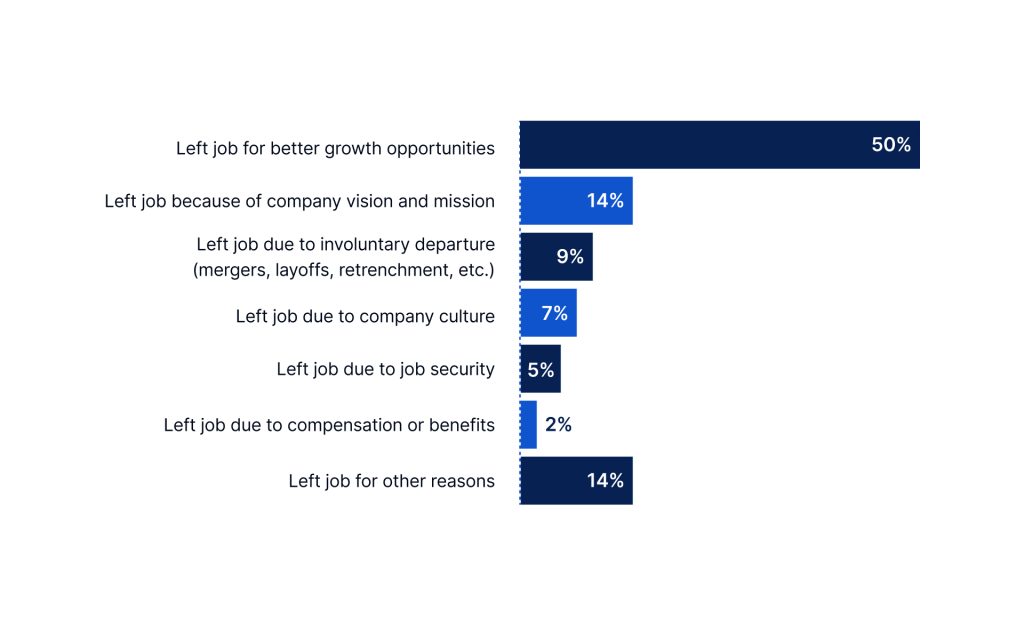

When it comes to motivations for job changes, 50% of respondents cited better growth opportunities. On the other hand, just 9% of job changes were due to involuntary reasons such as layoffs or company withdrawal from the market.

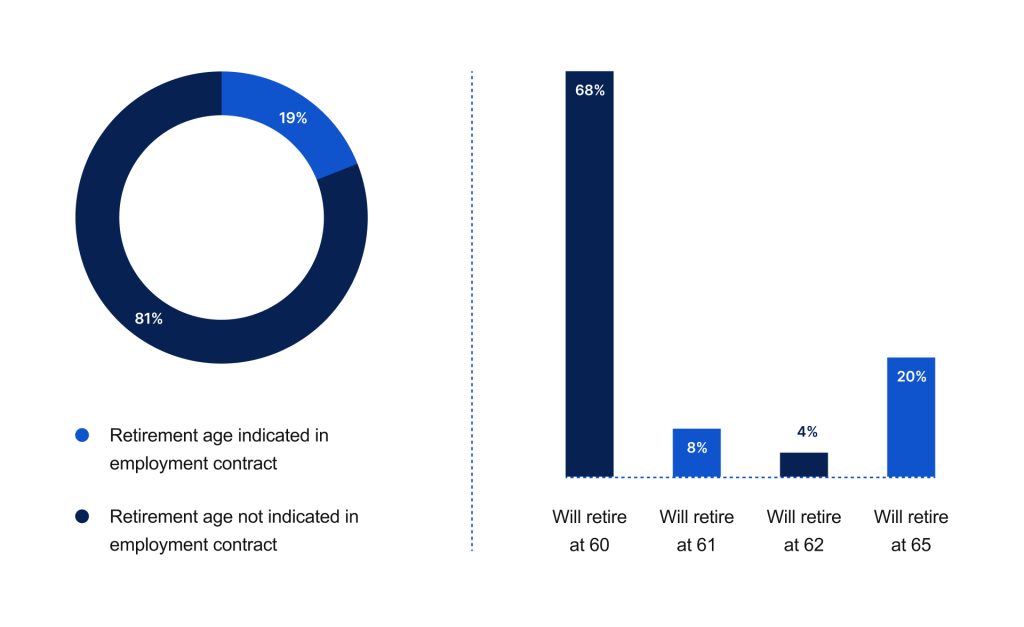

The data relating to retirement age reveals mixed attitudes. While just 19% of those surveyed have a specified retirement age in their contracts, among that subgroup, retirement is expected prevalently at 60 years (68%) or 65 years (20%). This could open up a discussion on job security and illustrate that offering a fixed retirement age in contracts can be an attractive proposition for certain job candidates.

Executive Compensation

An analysis of the participants’ earnings reveals a significant segment of General Managers in the bracket of 71% earning 300 million won (232 406 USD) or less per annum. This establishes a benchmark for typical General Manager compensation in the market.

On the extreme ends of the spectrum, we find 1% at the top earning over 1 billion won (775 756 USD) and 6% at the bottom earning between 100 million won (77 575 USD) but less than 150 million won (<116 355 USD). These outliers provide a broader understanding of wage extremes within the field.

Critically, about 71% experienced a salary increase of less than 5% over the past three years. With inflation and living costs typically rising 2-3% per annum, this could imply a real-term wage stagnation or even shrinkage for these individuals. Businesses may thus need to evaluate their compensation enhancement strategies to ensure they retain their executive talent.

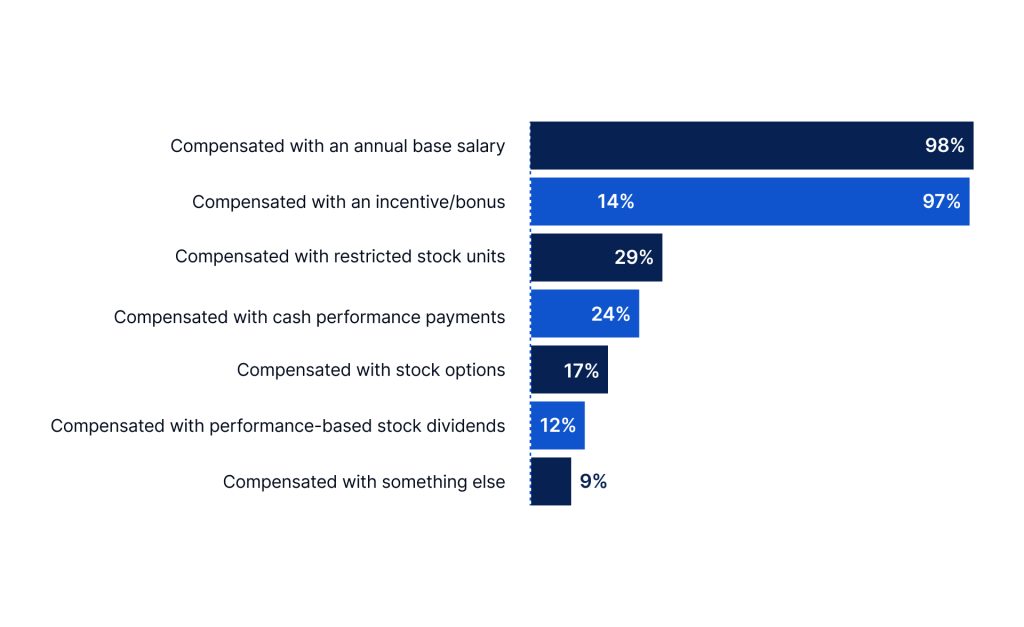

A separate focal point is the overall compensation package. Ninety-seven percent of General Managers receive incentives such as bonuses, 29% receive restricted stock units, and 24% are offered cash performance payments. However, levels of satisfaction vary for each incentive. Specifically, our findings show that 30% of respondents feel the structure of long-term cash performance payments needs improvement. This suggests that firms may need to reevaluate how these payments are structured and communicated to enhance employee satisfaction and engagement.

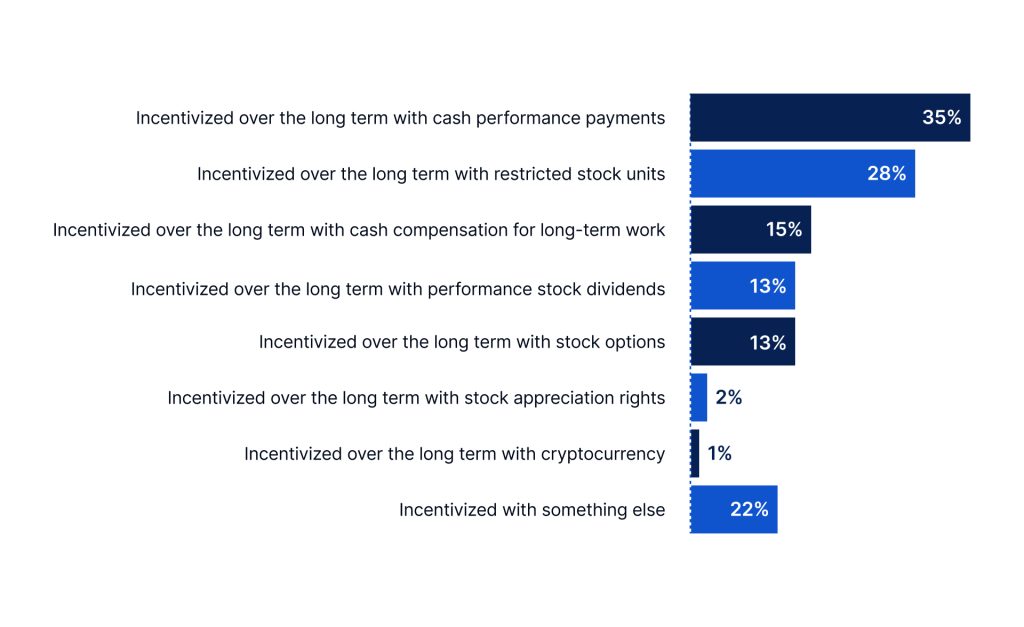

The extensive usage of Restricted Stock Units (RSUs) and Performance-Based Stock Dividends (PBSDs) as long-term incentives indicates that businesses are adopting a performance-oriented compensation approach, aligning executive rewards with the company’s success.

The introduction of cryptocurrency as part of the compensation package highlights an intriguing trend bridging the gap between traditional corporate structures and the evolving digital market. Though currently offered to a small percentage of respondents, this could hint at potential future shifts in compensation strategies.

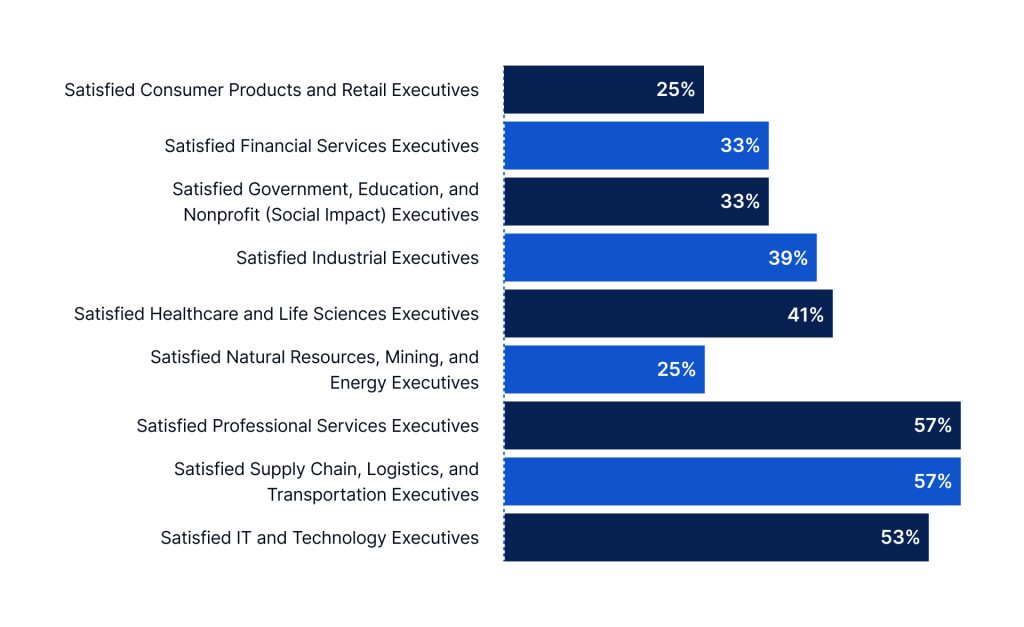

Our survey results also highlight sector variabilities in terms of satisfaction with compensation and benefits. The industries with the most satisfied respondents include professional services, supply chain, logistics, and transportation, and IT and technology. Dissatisfaction is most pronounced in consumer and retail and the natural resources, energy, and mining sectors.

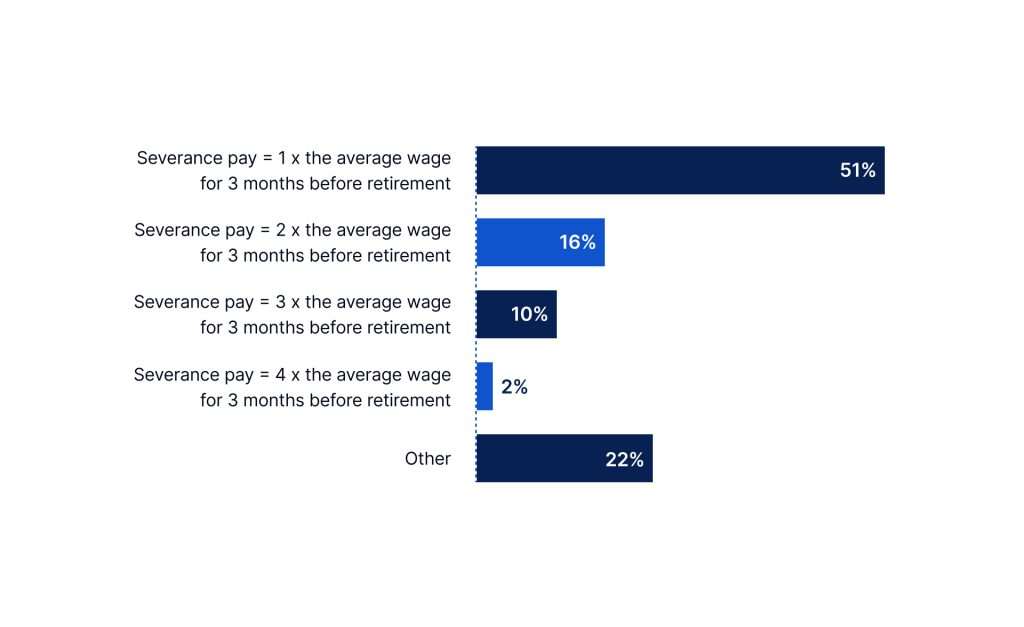

When it comes to severance pay, most respondents (51%) indicate it’s calculated as “1 times the average wage for 3 months before retirement”. Businesses may want to consider this as a benchmark, with the knowledge that deviations, such as the 16% offering 2x and the 10% offering 3x, seem to be less common.

Executive Benefits

As our survey found, benefits extended to General Managers in Korean companies span a wide range, from insurance and outplacement services to more unique offerings such as license allowances.

Customarily, the most common benefits provided by companies include group insurance, lunch costs, and vehicle support without a personal driver, which are offered by over two-thirds of employers. It’s interesting to note that despite being perceived as valuable, benefits such as license allowances, retirement plans, and outplacement services are less common, hinting at potential areas for companies to differentiate themselves.

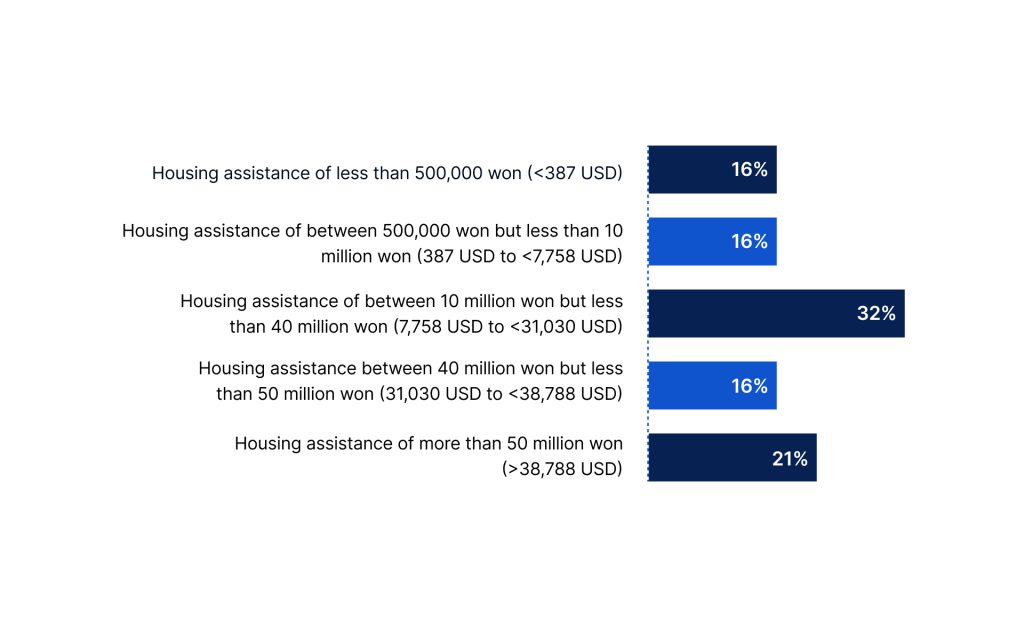

What stands out in the data is that housing assistance, a usually appreciated benefit, is quite uncommon, offered only by 15% of companies. There also appears to be considerable variability in the scale of housing assistance offered, ranging from less than 500 000 won (387 USD) to over 50 million won (38 773 USD). This diversity in offerings may reflect differing company approaches towards balancing overall compensation packages.

Regarding leave, the majority of respondents enjoy 21 to less than 25 paid vacation days annually, with a small segment (9%) having 31 or more days. Intriguingly, 8% of survey respondents reported having 15 days of leave or less. Such low leave allowances might negatively impact work-life balance and employee satisfaction, ultimately affecting overall performance and retention rates.

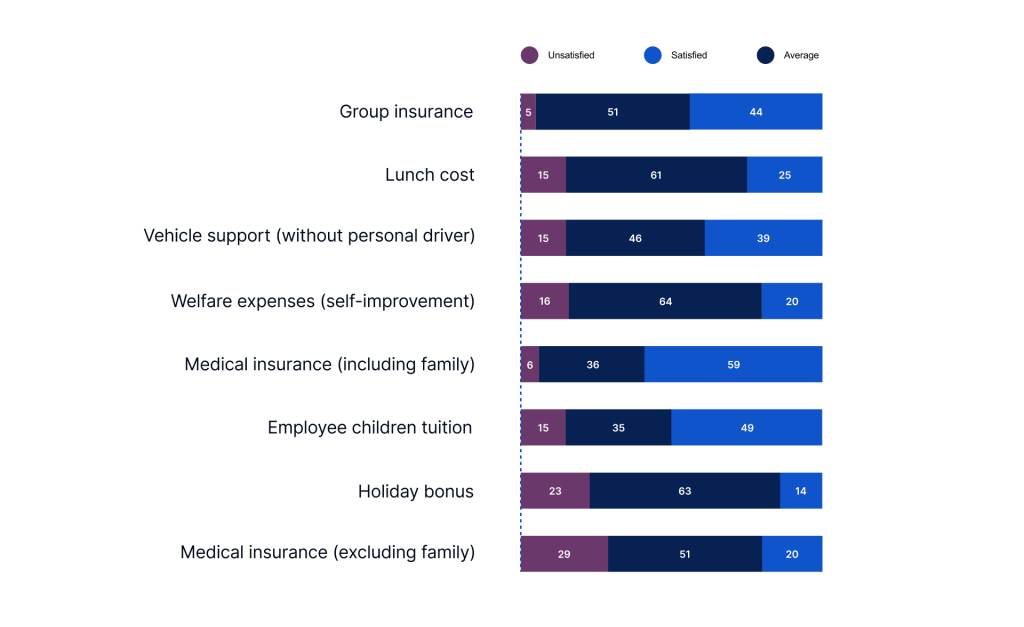

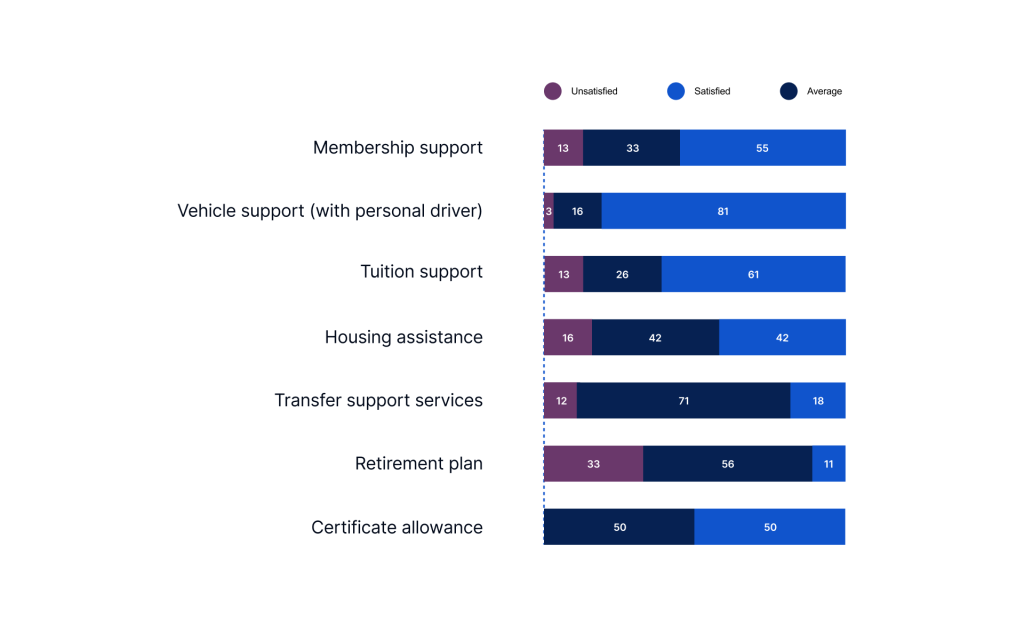

When it comes to benefit satisfaction, it appears that quality trumps quantity: the most satisfying benefits are not necessarily the most common. For example, vehicle support, especially when it includes a personal driver, yields the highest satisfaction at 81%. Similarly, tuition support, while not among the most commonly offered benefits, ranks second in satisfaction at 61%.

In contrast, certificate allowance and retirement design, despite being part of the benefit package, record significantly lower satisfaction ratings. This discrepancy suggests that businesses could potentially reap higher employee satisfaction by investing in highly valued benefits like vehicle support, rather than spreading resources across a wide array of less-valued benefits.

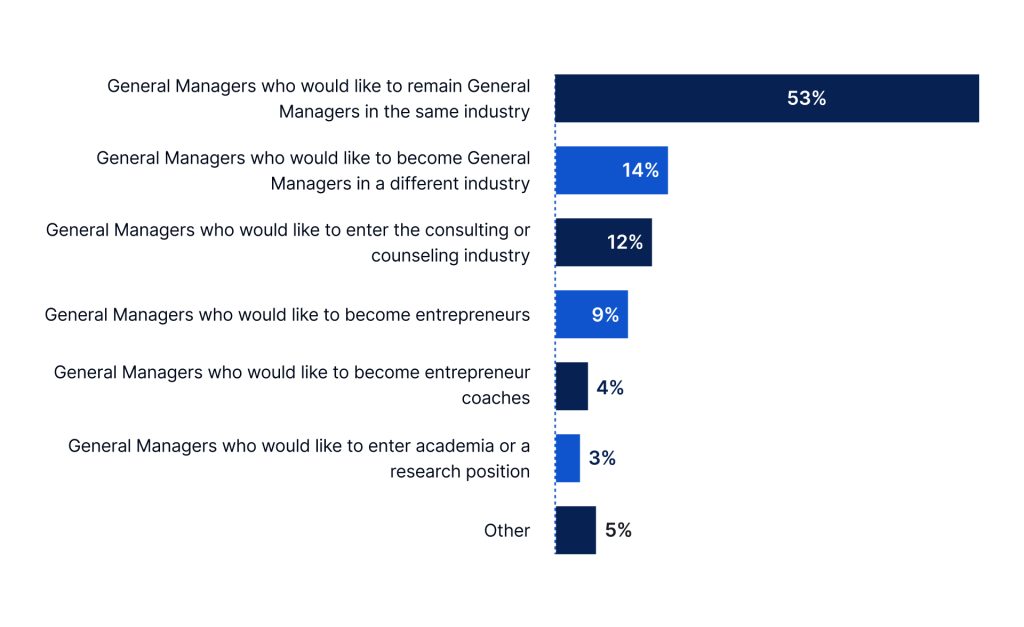

According to our survey results, the majority of General Managers, about 53%, have expressed intentions of remaining in their current industry, illustrating their commitment to the field. Some General Managers, however, are open to exploring other spaces, with 14% wishing to transition to different industries while holding the same role.

An intriguing minority of respondents, accounting for 9%, have voiced interest in entrepreneurship, while another 4% have an inclination towards entrepreneur coaching. These findings suggest that some General Managers view their tenure as a steppingstone to entrepreneurial ventures. Counseling or consulting, and academia attract another subset of General Managers, at 12% and 3%, respectively. This suggests that having molded successful careers, some General Managers may be inclined to impart their wisdom and experience to others through consulting or academic channels.

Looking deeper into the reasons triggering a job change, growth potential and opportunities within the organization emerge as the tipping point for the decision to leave or continue with a company. Ironically, the same factors also play a compelling role when choosing a new job.

While compensation and benefits might intuitively seem as a key determinant, the report astonishingly dismisses it as the primary factor influencing leaders’ decision to quit or stay with a company. This underscores the growing importance of career growth and job satisfaction at the General Manager level, pushing companies to look beyond financial incentives for the retention of senior-level executives.

Businesses thus might want to focus on offering clear growth trajectories and bolstering job satisfaction to ensure a longer and more productive engagement with their General Managers.

How to Find Top Executives, C-Suite Leaders, and Board Members in Korea

Korea, with its unique blend of tradition and innovation, presents a compelling canvas for international companies to broaden their horizons. However, its distinct cultural and business landscape necessitates a thorough understanding of local customs and executive talent management practices.

Luckily, you’re not alone on this journey. We provide a strategic partnership, anchored in Seoul, to navigate through these unique challenges inherent to the Korean market. We offer a range of services, including executive search, succession planning, leadership assessment and development, as well as board services. Our expertise is not only fine-tuned to the Korean market but is also personalized to enhance the caliber and potential of Korean executives.

Our mission is to ensure your international expansion seamlessly integrates with your existing operations and elevates your company to new heights of success. Click here to reach out to one of our consultants.

About the Author

Tony Kang is the Managing Director of Stanton Chase Korea and the Regional Vice President of the Asia Pacific (APAC) region. He has over 23 years of experience working for various leading multinational pharmaceutical, medical device, and optical companies in Korea and the United States. During his career, he developed extensive leadership and business experience and an unparalleled track record of success in the healthcare industry. He previously served in a senior marketing capacity at Eli Lilly in the US. Thereafter, he served as General Manager for companies such as Allergan Korea, Biopol Korea, and Carl Zeiss Vision Korea.

How Can We Help?

At Stanton Chase, we're more than just an executive search and leadership consulting firm. We're your partner in leadership.

Our approach is different. We believe in customized and personal executive search, executive assessment, board services, succession planning, and leadership onboarding support.

We believe in your potential to achieve greatness and we'll do everything we can to help you get there.

View All Services