The benefits of resilient and strategic sustainable corporate governance

The spotlight is definitely on stakeholder capitalism (SC) in talks around sustainable corporate governance with the World Economic Forum, the IBC, the Business Roundtable, Principles for Responsible Investments PRI, the UN’s SDGs initiatives, UNEPFI, EGDIP and Once-in-a-Generation programs and EU Sustainable CG & Taxonomy regulations and EBA Risk Report all championing the principles of capitalism.

In light of the global pandemic, racial injustice, inequality, and climate change – to name just a few of the challenges facing modern-day society – the public is putting pressure on companies to create wider value for global sustainability. The business community has begun to rethink capitalism by realigning their corporate values, purpose, and mission with sustainable strategies and ethical business models, ESG principles, and sustainable corporate governance.

A sustainable corporate governance model nowadays should incorporate a resilient and competitive long-term strategy as well as ethical business models to meet stakeholders’ goals and expectations under the appropriate and measured equilibrium of Stakeholder Capitalism Metrics within the pillars of principles of governance, planet, people, and prosperity, which return value to all.

What is stakeholder capitalism?

In principle, SC is based on a governance model aimed at creating sustainable wealth and prosperity while ensuring that all the stakeholders, including the company itself, receive these benefits and values. It is supported by a viable business model that focuses on accountability to all stakeholders and encourages companies to take a more holistic approach to communities and understand the impact the company’s actions have on these.

In practice, corporations adopt a long-term thinking culture and approach to value and sustainable growth as opposed to focusing on short-term shareholder objectives. Thus, greater matters such as management of intangible assets for competitive advantage through employee engagement, talent development and motivation, fostering innovative culture, information technology, risk management, LT strategy, company purpose, and environmental stewardship all receive appropriate attention to enable the optimization of organizational effectiveness, efficiency and performance.

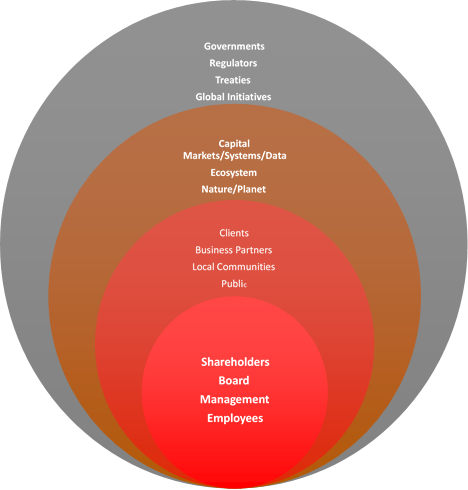

Stakeholders Ecosystem Equilibrium

The Stakeholders Ecosystem Equilibrium encompasses all the environments of stakeholders impacting or impacted by the company’s activities.

Within these environments are seven main classes of stakeholders:

- Customers / clients

- Shareholders

- Employees

- Business partners

- Government / regulators

- Communities impacted

- The company and its purpose

Why is stakeholder capitalism critical?

For a company to be successful in today’s disruptive world, it needs to succeed in the following fundamental strategic areas:

- Ethical corporate purpose, values, and mission

- Sustainable long-term direction

- Profitable business modeling

- Competitive advantage

- Organizational resiliency

- Trustful relationship with all stakeholders

Stakeholder capitalism lies at the heart of these strategic areas as it thrives in any company where the corporate mission, strategy, and execution plans are clearly articulated and streamlined into a business model that provides equal value to all classes of stakeholders.

“Stakeholder capitalism thrives in any company where the corporate mission, strategy, and execution plans are clearly articulated.”

This wider-value stakeholder return concept is critical to the success of businesses and society getting aligned under a common purpose. That wider purpose pushes a corporation to create long-term value for each key stakeholder group without derailing from their business strategy by actually facilitating the generation of superior financial returns through engagement, increased productivity and innovation. At the center of it all lies the corporation and all its stakeholders. The long-term viability of the business, the protection of the company’s reputation, its purpose and social license to do business, and the proactive management of risk factors are priorities for all stakeholders at the end of the day.

How should the board approach SC within their CG system?

The board’s Chair, its Directors, and the company’s CEO should begin by evaluating whether the company’s governance model governs the business model to stay within that governing framework of purpose, values, vision, and equal value return.

Overall, a SC measurement process within corporations leads to balance sheet and value sheet disclosures where shareholders and stakeholders deliver constructive oversight to assess and fairly value corporate performance. It helps increase accountability, reward leadership, and supports boards of directors and executive management in their fiduciary and business roles.

How can the board implement a sustainable stakeholder governance model?

A company’s sustainable corporate governance model nowadays should incorporate a resilient and competitive long-term strategy as well as ethical business models to meet stakeholders’ goals and expectations under the appropriate and measured equilibrium of Stakeholder Capitalism Metrics.

The equilibrium of Stakeholder Capitalism Metrics lies within four pillars of ESG: principles of governance, planet, people, and prosperity, commonly referred to as the 4Ps.

The company’s measurement of the value return for each of these categories of ESG metrics will determine the progress made by the company over time in engaging its stakeholders in a common purpose of wider value return.

The Stanton Chase Board Advisory has established a comprehensive portfolio of CG services in accordance with the latest best practices that cater to the principles of governance pillar.

Our experienced Board Advisory team in Athens have designed leading CG solutions with a range of services including:

- Board effectiveness and performance evaluations

- Board Individual & Collective Suitability assessments

- Board succession planning

- Fit & Proper assessments

- CEO and executive management succession planning

- CEO evaluations SRM

- Targeted board profiles architecture and nominations

- Board of directors assessments BoD Multiview

- Corporate governance leadership, engagement, and culture

- Board development programs

- Digitization of board operations

What is the future direction of EU regulatory guidelines on sustainable corporate governance?

As part of the European Green Deal, the European Commission has introduced a Sustainable Corporate Governance Initiative with a plan for adoption in Q2 of 2021. This initiative aims to improve the EU regulatory framework on company law and corporate governance. It will enable companies to focus on long-term sustainable value creation rather than short-term benefits. It aims to better align the interests of companies, their shareholders, managers, stakeholders, and society. It will help companies to better govern and manage sustainability-related matters in their own operations and value chains as regards social and human rights, climate change, and the environment by putting forward standards and transparency for the methodology when it comes to ESG reporting.

What are the benefits and incentives for companies to engage in SC through sound corporate governance?

Stakeholder capitalism principles are designed to promote the optimization of long-term value for all stakeholders, including the company itself.

The adoption of stakeholder capitalism by shifting from a balance sheet to a value sheet approach can provide a number of critical advantages:

- Ensure access to resilient and recovery financing programs for sufficient investment in the resources of human, financial, R&D, and technological innovation necessary to develop and execute long-term strategic plans

- Create competitive business models and adaptable operational structures that promote growth, diversity, inclusion, and innovation

- Foster collaborative partnerships with government and civil society

- Promote strong ethical leadership and develop a culture of integrity

- Establish a value sheet measurement over and above the balance sheet reporting to clearly measure stakeholder performance and returns

- Promote trust among stakeholders to maximize engagement

- Attracts long-term-oriented investors

- Targets an ecosystem of economic growth for increased capitalism participation

- Achieve employee engagement, motivation, development, and efficiency

- Optimize organizational performance, effectiveness, and resilience

- Instill a corporate culture of purpose within the organization

The profound potential of SC is already apparent

When the Covid-19 pandemic hit, businesses were struck with major disruptions as workers almost everywhere around the globe packed up and went home. Most feared the effects would be so detrimental that a social and economic meltdown would follow.

Yet, each worker and employee instinctively became an entrepreneur from home, helping to bring about remarkable productivity and digital innovation for their organization. It is the people who created this value and innovation, not technology or computers.

The first signs of companies with remarkable resilience and innovation are a testimony to the fact that it is people, in other words stakeholders themselves, who create the value.

“The first signs of companies with remarkable resilience and innovation are a testimony to the fact that it is people, in other words stakeholders themselves, who create the value.”

It is difficult to deal with today’s problems without understanding those of yesterday.

As history and the ancient Greek experience have taught us, expressed precisely in Pericles’ Funeral Oration, the alignment of Athenian organizational goals with those of individual goals would transform society to the benefit of both.

As later described by Plato with remorse, the ideal Athens failed to become a sustainable reality when the equilibrium of all stakeholder interests was lost.

Democracy was founded on the people-centric philosophy of the ancient Greeks.

Stakeholder capitalism is the evolution of the notion of democracy on a global scale where every member within our societies and markets is involved in creating and sharing prosperity and value to enable a better world for all.

Stanton Chase Partnership with Nasdaq Corporate Governance Engagement Solutions International

Stanton Chase maintains a collaborative partnership with Nasdaq Corporate Solutions International, as its preferred partner for board governance solutions. This collaboration will bring together the Nasdaq Governance Solutions with Stanton Chase executive search expertise, adding more value to an already extensive portfolio of sustainable corporate governance and board leadership services.

This strategic alliance strengthens board service offerings at Stanton Chase in over 70 offices around the globe.

Nasdaq Governance Solutions have now been combined with Stanton Chase executive search and assessment capabilities, allowing us to deliver highly tailored services that will help bring your board to a new level.

To learn more about how the Nasdaq-Stanton Chase partnership can benefit your business, contact your local Stanton Chase consultant: www.stantonchase.com/international-locations

References:

- FCLT Global Organization 2021

- Executives Embrace Stakeholder Capitalism at Davos, Nasdaq 2020

- World Economic Forum (WEF) Measuring Stakeholders Capitalism 2020 Reports

- WEF and Baker McKenzie The Future of Corporation 2021 Report

- ESG Engagement 2020 Nasdaq Report

- EU European Commission DG Justice and Consumers Sustainable Corporate Governance Initiative 2020/21 Reports

- Investor Priorities for the EU Green Deal-PRI Report 2020

- International Business council (IBC) Reports 2021

- The Classic Touch, John.k. Clemens

- The panel discussion on “Sustainable Corporate Governance & Stakeholder Capitalism” in the 8th CG Conference of the American-Hellenic Chamber of Commerce, with guest speakers Peter Georgescu, Author & CG professional, Paul Thanos, Director for Finance and Insurance Industries at the U.S. Commerce Department’s International Trade Administration, Byron Loflin, Global Head of Board Engagement in Nasdaq Governance Solutions and George Vlachos as panel host and moderator

About the Author:

George Vlachos is a corporate governance professional and an organizational development, change, and purpose leadership expert with extensive international experience in corporate governance engagement, Board & ExCom architecture, composition and effectiveness evaluations across various industries.

He is currently International Director for the Board Advisory practice at Stanton Chase, a strategic partner with Nasdaq Board Engagement Solutions, and a Council Member of The Corporate Governance Institute.

How Can We Help?

At Stanton Chase, we're more than just an executive search and leadership consulting firm. We're your partner in leadership.

Our approach is different. We believe in customized and personal executive search, executive assessment, board services, succession planning, and leadership onboarding support.

We believe in your potential to achieve greatness and we'll do everything we can to help you get there.

View All Services