In the early 2020s, the concept of the “retail metaverse” generated tremendous buzz and excitement.

Major retailers and brands rushed to stake their claims in immersive virtual shopping worlds. They envisioned a future where consumers would flock to browse and buy in the metaverse.

Fast forward to 2024 and the retail metaverse lies in ruins, with most initiatives abandoned as expensive failures. What went wrong and is there any hope of resurrecting the retail metaverse? Let’s examine the key factors behind its demise and assess future prospects.

The Hype Bubble Bursts

The retail metaverse fell victim to massively inflated expectations and hype, driven by tech evangelists and overeager executives jumping on the bandwagon. A 2022 PWC survey found that more than eight out of 10 executives expected the metaverse to be a part of their business operations by 2025. And JP Morgan projected the metaverse could generate $1 trillion USD in yearly revenues.

While executives were optimistic, they perhaps lacked a data-driven approach to the metaverse expansion. For instance, Publicis Sapient research mentioned that 60% of ROI from the metaverse arises from owned e-commerce, not entirely from an immersive metaverse experience, suggesting a disparity between expectations and practical revenue generation models.

Meta’s Reality Labs, the division dedicated to the metaverse and virtual reality operations, reported some not-so-insignificant financial losses, which highlights the challenges of monetizing the metaverse. For example, Reality Labs recorded a loss of $3.73 billion in one quarter alone in 2023, and the company’s quarterly profits decreased by 8 percent from the previous year in the first quarter of 2022, indicating the direct impact of metaverse investments on the overall financial health of Meta.

Amid the frenzy, hard questions went unasked about consumer demand, technical feasibility, and ROI. When lofty visions collided with reality, the bubble burst spectacularly.

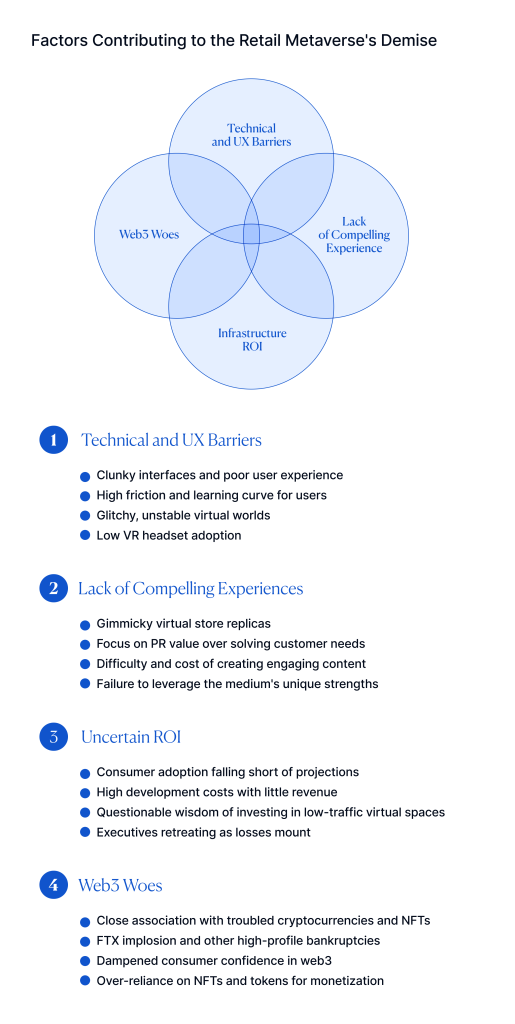

1. Technical and UX Barriers

Early iterations of the retail metaverse were plagued by technical glitches, clunky interfaces, and a subpar user experience compared to web and mobile shopping. Retailers underestimated the challenge of building stable, user-friendly virtual worlds at scale. Critically, the friction and learning curve proved too high for mass adoption. Most consumers simply had no compelling reason to shop virtually vs. the convenience of Amazon, for example.

VR headset adoption also badly lagged metaverse proponents’ projections. Despite price cuts, only 18% of US citizens owned a VR device by March 2022 according to Statista. These numbers would likely have been even lower in other countries. Without an easy-to-use, non-gated entry point for the masses, retail metaverses remained a niche novelty for tech enthusiasts.

2. Lack of Compelling Experiences

Retail metaverses largely failed to deliver truly unique, must-have shopping experiences that played to the medium’s strengths. Too many were gimmicky virtual replicas of physical stores that focused more on PR value than solving real customer needs. Retailers soon discovered that continuously creating compelling metaverse content was difficult and costly.

Statista also forecasted significant growth for metaverse eCommerce, projecting a market volume of $210.3bn USD by 2030. But the necessity for compelling metaverse content versus gimmicky experiences was not met, leading to a disconnect between predicted market growth and actual consumer engagement.

3. Uncertain ROI

With consumer adoption falling short and development costs spiraling, retail metaverse initiatives struggled to demonstrate positive ROI. Executives who had eagerly funded metaverse ambitions beat swift retreats as losses mounted with little revenue to show for it.

A good example of this is Meta itself. Reporting revealed that Meta spent $36 billion USD on its metaverse between 2019 and 2022, and as of 2024, it hasn’t seen the kind of ROI you’d expect from that investment. Marketers began to question the wisdom of investing in pricey virtual flagships with minimal foot traffic or sales impact.

4. Web3 Woes

The metaverse’s close association with cryptocurrencies and NFTs became a liability as the web3 space weathered major turbulence. The implosion of FTX and other high-profile bankruptcies tarnished crypto’s reputation, dampening consumer confidence. Between January 2022 and September 2022, NFT trading volume decreased by 97%.

Many retail metaverse projects had bet big on NFTs and tokens as drivers of engagement and monetization. The web3 fallout left these initiatives exposed. By 2024, consumer backlash saw several retailers wind down their NFT efforts. Metaverse commerce’s reliance on the web3 ecosystem proved to be built on shaky foundations.

Prospects for Revival

After the brutal shakeout of 2023-24, what are the prospects for a retail metaverse revival? Certainly the heady visions of just a few years ago now seem farfetched. Yet some seeds of potential remain for a more targeted, niche-driven resurgence:

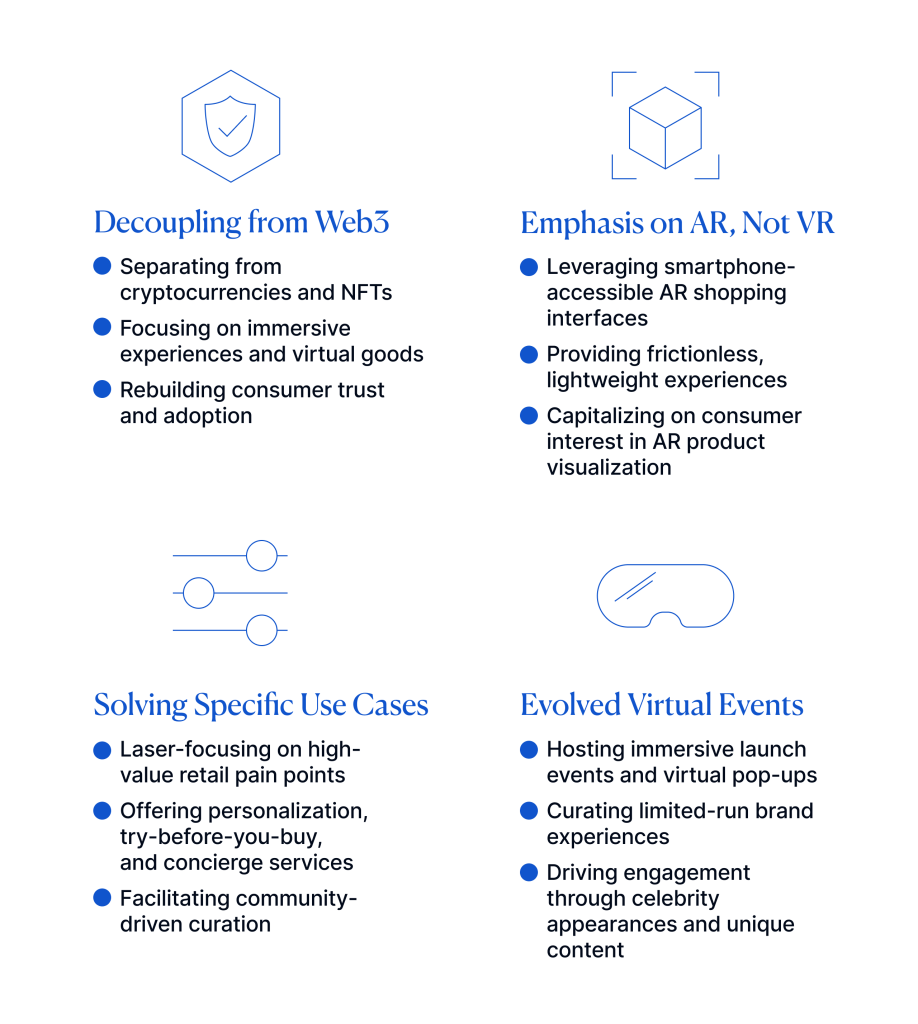

1. Decoupling from Web3

A new generation of retail metaverse initiatives may find success by decoupling from crypto and NFTs and focusing purely on unique immersive experiences and virtual goods. With web3 baggage jettisoned, consumer trust and adoption could rebound.

2. Emphasis on AR, Not VR

Lighter-weight, frictionless AR shopping interfaces accessible from smartphones could sidestep VR’s adoption barriers. Roughly 77% of consumers express interest in AR product try-on and visualization. Engaging AR experiences on Snap and TikTok hint at the potential.

3. Solving Specific Use Cases

Metaverse stores could thrive by laser-focusing on solving high-value retail pain points vs. replicating full shopping experiences. Strong candidates include personalization, try-before-you-buy, concierge services, and community-driven curation.

4. Evolved Virtual Events

Immersive launch events, virtual pop-ups, and limited-run brand experiences could drive buzz and engagement without major upfront investment. Metaverse events powered by celeb appearances and unique content may find an audience.

Should Your Retail Company Invest in the Metaverse?

The retail metaverse of 2030 will likely look very different than pioneers envisioned in 2022. Scaled-back, targeted executions focused on clear use cases and improved UX may gradually win over skeptical consumers. But a mass migration to shopping in sprawling virtual worlds remains unlikely.

Hard lessons have been learned about succumbing to hype over substance. The retail metaverse’s second act, if it comes, will be more modest, grounded and niche-driven—slow evolution, not a revolution.

Hard lessons have been learned about succumbing to hype over substance.

If anything, the retail metaverse’s initial meteoric rise and spectacular crash offers a cautionary tale about inflated expectations outpacing technological and consumer readiness. Yet glimmers of potential remain for a more humble, targeted resurgence solving specific pain points and emphasizing compelling experiences over shiny objects.

Retailers will be closely watching consumer sentiment and metaverse adoption trends to determine if and how to place their bets. One thing is clear: a more clear-eyed, ROI-driven mindset will be important for the retail metaverse’s next chapter.

About the Author

Milos Tucakovic is a Managing Partner at Stanton Chase Belgrade. He is also Stanton Chase’s Consumer Products and Services Global Sector Leader.

Milos has almost two decades of executive search and leadership advisory experience, and prior to this accumulated nearly 30 years of human resources and management experience.

Milos is a member of the Serbian Association of Managers and Knowledge Committee of Serbia. He also lectures on management at the College of Hotel Management in Belgrade.

How Can We Help?

At Stanton Chase, we're more than just an executive search and leadership consulting firm. We're your partner in leadership.

Our approach is different. We believe in customized and personal executive search, executive assessment, board services, succession planning, and leadership onboarding support.

We believe in your potential to achieve greatness and we'll do everything we can to help you get there.

View All Services